SEKHARCHANDRA & ASSOCIATES

About Us

- Home

ABOUT US

We are SCA Associates

SEKHAR CHANDRA & ASSOCIATES (SC&A) was started in 2020 with the intention to provide services, advising domestic and international clients, and providing a broad range of legal, taxation, and advisory services to the commercial, industrial and financial communities. We are one of very few CA firms in India that has a unique combination of tax practice, management consultancy and other services (MCA), and corporate law. Further, we provide one-stop resource and support services from pre-establishment government approvals to post-establishment setup services. We are having our presence both in Karnataka and Andrapradesh to offer under noted services.

GET IN TOUCH

Get a Free Expert Consultation For Your Business

TEAM MEMBERS

Meet Our Partners

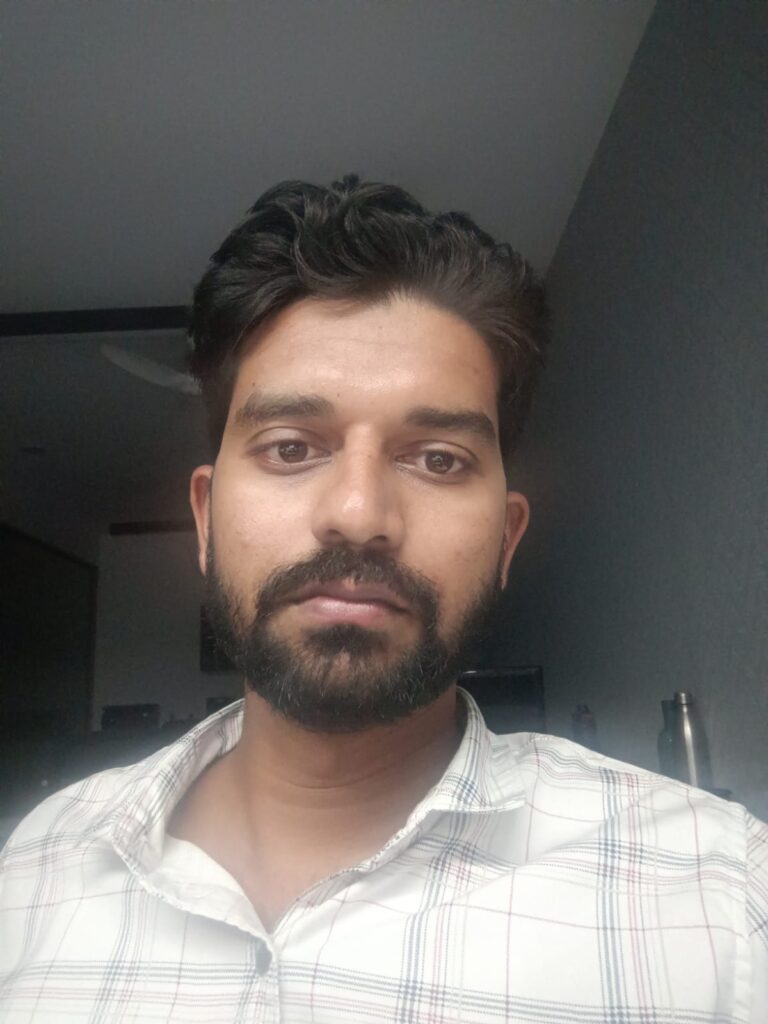

CA. Rajasekhar, a distinguished member of the Institute of Chartered Accountants of India (ICAI) and the Managing Partner at SC&A, brings extensive expertise in Indian laws, regulations, and practices.With a robust background in auditing,taxation,and commercial laws,he is proficient in financial analysis,reporting,corporate governance,and risk management.Rajasekhar has successfully led audits across various industries, ensuring strict compliance with Indian accounting standards while offering strategic recommendations for operational improvements.As a specialist in corporate and international taxation,he provides comprehensive advisory services on tax planning,transfer pricing, and cross-border transactions.His proven track record in compliance management aids clients in navigating complex regulatory landscapes and mitigating risks.and is actively involved in charitable activities.

Highly skilled GST Expert with extensive experience in Goods and Services Tax (GST) compliance, advisory, and planning. Proficient in GST return filing, tax audits, and managing GST-related disputes. Adept at providing strategic tax advice to optimize tax liabilities and ensure full compliance with the latest GST regulations. Demonstrates strong analytical skills, attention to detail, and the ability to navigate complex tax scenarios effectively.

Over half a decade of experience in areas such as Statutory Audit, Internal Audit, Tax Audit, Corporate Law & Business advisory, Tax planning & Corporate restructuring. During this course he was also successful in assisting Multinational Corporates in setting up their affiliates and helping them in designing and Implementation of controls to mitigate the risks arising in various processes. Further he has experience in IND AS Implementation and advisory and represented various cases before Direct tax and Indirect Tax Authorities.Mr. T. Naresh is an Associate chartered Accountant, Commerce Post Graduate, Associate Cost Management Accountant from the Institute of Cost Accountants of India. Prior to G C N & CO, he was associated with S Janardhan & co Chartered Accountants and have worked as Finance Manager in Surin Automotive

Naresh Tummalapalli, ACA, a distinguished practicing Chartered Accountant who embarked on his professional journey in 2020. His early career was cultivated through enriching experiences with two prominent Chartered Accountant firms based in Bangalore. Fueled by a passion for audit, taxation, and financial services, Naresh has been instrumental in steering numerous clients towards realizing their financial aspirations.

Naresh’s forte lies in leveraging his expertise in business consultancy and advisory services to empower clients, aiding them in reaching their financial milestones. His unwavering commitment to excellence is underlined by a wealth of knowledge and practical insights, fostering bespoke solutions that cater precisely to the unique needs and requirements of his clientele.

Driven by a dedication to providing unparalleled professional services, Naresh Tummalapalli is steadfast in his pursuit of delivering the highest quality advisory, meticulously tailored to propel his clients towards sustainable success.

CA Chandra Obulesu E, brings With extensive experience as a Chartered Accountant, He specialized in delivering high-quality financial services, including audit, taxation, and advisory. He conducts thorough tax audits to help businesses navigate complex tax landscapes, ensuring accurate reporting and adherence to statutory requirements. He has a proven track record of helping businesses optimize their financial strategies, ensure compliance with regulatory standards, and enhance operational efficiency. His expertise spans across various industries, enabling me to provide tailored solutions that meet the unique needs of each client. Committed to accuracy and integrity, He strives to support businesses in achieving their financial goals. Also With specialized expertise in the Foreign Exchange Management Act (FEMA), He has extensive experience in advising clients on cross-border transactions, compliance with foreign exchange regulations, and structuring investments. His work includes assisting businesses with regulatory approvals, managing foreign remittances, and ensuring adherence to FEMA guidelines. He also provide strategic guidance on foreign direct investment (FDI), external commercial borrowings (ECB), and outbound investments, helping clients navigate the complexities of international finance and regulatory frameworks.